Your Guide to Financing in a Growing Community

Explore Affordable Home Financing Options in Lufkin and Unlock Your Path to Homeownership

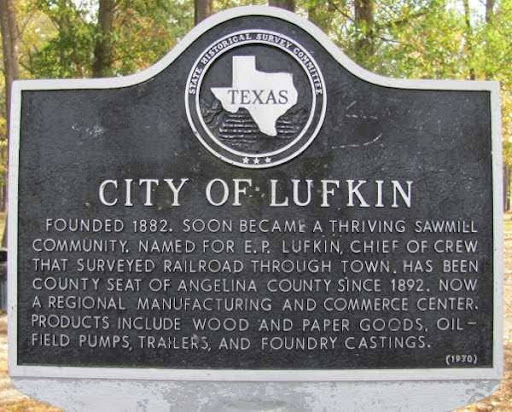

Lufkin offers a unique combination of charm and growth. Known for its lush pine forests, strong community spirit, and affordable housing options, Lufkin is a wonderful place to settle down. Whether you’re a first-time homebuyer or an experienced homeowner looking to relocate, Lufkin’s housing market provides a variety of opportunities. With competitive mortgage rates and diverse financing options, the home loan process can be rewarding and straightforward.

"*" indicates required fields

When looking for a home loan in Lufkin, you’ll find several mortgage options designed to fit your needs. From first-time homebuyer programs to refinancing opportunities, here’s an overview of some of the most common types of home loans in the area.

Federal Housing Administration (FHA) loans are government-backed mortgages designed to help buyers with lower credit scores or smaller down payments. FHA loans are an excellent option for those seeking a more affordable path to homeownership in Lufkin.

FHA loans are ideal for individuals with lower credit scores or those who can make a smaller down payment. With down payments as low as 3.5%, they make homeownership more accessible to a broader range of people. These loans also come with more flexible qualification criteria, making them a good option for first-time homebuyers or those who have experienced financial hardship.

FHA loans are available to borrowers with credit scores as low as 580, though a higher score (typically 620) may be required for specific conditions. The loan limits vary by location, but these loans are generally designed to help individuals with limited incomes. You’ll need to provide proof of income and meet the debt-to-income (DTI) ratio requirements, and the home must be your primary residence.

If you’re a veteran or an active-duty military member, a VA home loan offers a great opportunity for homeownership in Lufkin. The U.S. Department of Veterans Affairs backs these loans and provides favorable terms, including no down payment and competitive interest rates.

VA loans are among the best options for eligible veterans, active-duty service members, and their spouses. These loans require no down payment and no Private Mortgage Insurance (PMI), making them highly affordable for veterans. Additionally, VA loans typically offer competitive interest rates and more lenient credit requirements than other loan types.

To qualify for a VA loan, you must meet certain service requirements, such as being an active-duty service member, veteran, or surviving spouse of a veteran. Lenders will also evaluate your credit history and income to ensure you can handle the mortgage payments. While no down payment is required, a funding fee may apply and will be included in the loan amount.

The U.S. Department of Agriculture (USDA) offers loans designed for homebuyers in rural areas, making Lufkin a perfect candidate for these loans. USDA loans are ideal for borrowers looking to purchase homes in rural or suburban areas. With no down payment required, these loans offer low-interest rates and reduced mortgage insurance costs, making homeownership more affordable for those who meet the income guidelines. USDA loans are also accessible for borrowers with less-than-perfect credit, though a minimum score of 640 is generally required.

To qualify for a USDA loan, you must purchase a home in a USDA-designated rural area. You must also meet specific income limits, which are based on the median income for the area where you plan to buy. Your credit score and debt-to-income ratio will also be reviewed to ensure you can afford the loan. USDA loans are intended for individuals with low to moderate incomes.

A conventional conforming loan is a popular choice for those with strong credit and the ability to make a sizable down payment. These loans comply with Fannie Mae and Freddie Mac guidelines and are typically used to purchase primary residences.

Conventional conforming loans offer competitive interest rates, making them an attractive option for borrowers with strong credit profiles, stable income, and good credit history. One of the main benefits is the potential to avoid Private Mortgage Insurance (PMI) if you can make a down payment of at least 20%. These loans also offer flexible terms and financing for a wide range of property types, making them suitable for first-time homebuyers and seasoned homeowners.

To qualify for a conventional-conforming loan, borrowers typically need a credit score of at least 620. Lenders will also assess your debt-to-income (DTI) ratio to ensure you can comfortably manage the monthly payments. While a 20% down payment is ideal to avoid PMI, some programs may allow as little as 3% down with PMI included.

For those interested in purchasing a manufactured home in Lufkin, specialized loan programs are available. These loans serve homes that are either newly built or already on a property and offer affordable financing options.

Manufactured home loans offer an affordable financing option for those interested in purchasing a manufactured home. These loans often require smaller down payments than traditional home loans, and financing terms can be flexible. Whether you’re purchasing a new or used manufactured home, these loans provide access to homeownership at a lower cost.

To qualify for a manufactured home loan, the home must meet certain standards, including being built to the HUD code and being situated on land you own or lease. Your credit score, income, and employment history will also be assessed to determine your eligibility. A down payment requirement of at least 5% is common, but it can vary by lender.

Jumbo loans offer larger loan amounts with higher limits, making them ideal for individuals seeking to purchase higher-value properties in Lufkin. Jumbo loans are designed for borrowers who require a loan amount exceeding the conventional loan limits established by Fannie Mae and Freddie Mac. These loans are ideal for purchasing luxury homes or properties in high-cost areas, offering higher loan amounts and flexible terms. While the interest rates may be slightly higher, jumbo loans allow you to finance larger properties with a single loan.

To qualify for a jumbo loan, you typically need a higher credit score (usually 700 or above), a stable income, and a larger down payment—often at least 20%. Lenders will closely examine your financial stability, including your debt-to-income ratio, to ensure that you can manage the higher loan amount.

Non-QM loans are ideal for borrowers who don’t fit the traditional mold. These loans offer flexible underwriting guidelines and are often used by self-employed individuals, real estate investors, or those with unique financial circumstances. Non-QM loans provide additional financing options for properties that may not meet the qualifications for a standard mortgage.

Eligibility for a Non-QM loan depends on the specific loan program. Generally, you’ll need a good credit history and proof of income; however, the documentation requirements may be more lenient than those for conventional loans. Non-QM loans are ideal for those who may not qualify for standard loans due to factors such as irregular income or high debt-to-income ratios.

Refinancing your existing mortgage can help you save on interest, lower monthly payments, or even access home equity. Lufkin residents have access to both cash-out and rate-and-term refinance options.

A cash-out refinance enables homeowners to borrow against their home’s equity, converting a portion of that equity into cash for renovations, debt consolidation, or other financial needs. This loan typically has a higher interest rate, but it can be a valuable tool for financial flexibility.

Rate-and-term refinancing is designed to either lower your interest rate or change the term of your mortgage (e.g., 30 years to 15 years). This can reduce monthly payments or allow you to pay off your loan faster.

Testimonials

Buying a home is more than just a financial decision—it’s about finding security, comfort, and a place where your life’s best memories will unfold. At The Texas Mortgage Pros, we know that every buyer’s story is unique. That’s why we fight to secure the best rates, simplify the process, and stand by your side every step of the way. With us, you’ll feel confident knowing you have a trusted partner who puts your family’s future first.

Now that you’re familiar with the various mortgage options available in Lufkin, take the next step in securing your dream home. Whether you’re purchasing for the first time, refinancing, or exploring special loan programs, there’s an option to fit your needs.

Reach out to our Home Loan Experts today at (877) 280-4833 to discuss your financing options and begin your journey toward homeownership in Lufkin, Texas.

Q: What is the minimum credit score required for a home loan in Lufkin?

A: The minimum credit score varies depending on the type of loan. FHA loans may allow scores as low as 580, while conventional loans typically require a score of 620 or higher.

Q: Who is the easiest to get a home loan through?

A: Because they’re guaranteed by federal agencies, FHA, USDA, and VA loans are typically the easiest to get approved for.

Q: What is the required down payment in Lufkin?

A: The down payment depends on the loan type. FHA loans require a 3.5% down payment, while USDA and VA loans offer no down payment, and conventional loans typically require a down payment of at least 3%.

Q: Are manufactured homes eligible for financing in Lufkin?

A: Yes, manufactured homes can be financed with specialized loan programs, but the house must meet specific requirements to qualify.