Your Essential Guide to West Texas Mortgage Financing and Affordable Homeownership Programs in Pecos

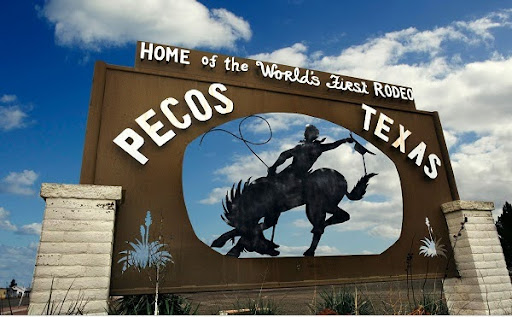

Welcome to Pecos, Texas, the “Home of the World’s First Rodeo” and a dynamic hub in the Trans-Pecos region, strategically located at the intersection of I-20 and U.S. 285. This historic city, renowned for its sweet cantaloupes and strong ties to the oil and gas industry, is dedicated to community growth through investments in education and regional entertainment, such as the Cyclone Ballparks. For those looking to put down roots, the Pecos housing market offers a more attainable entry point than many other Texas cities. While home values have recently experienced some fluctuations, Pecos continues to be an area of focus for affordable workforce housing, supported by local entities such as the Pecos Housing Finance Corporation (PHFC), to ensure that housing remains within reach for working families.

Navigating the landscape of Pecos mortgage financing is the first crucial step toward homeownership. In this market, you have access to a wide array of loan programs designed to meet different financial profiles, ranging from traditional options that require strong credit to government-backed programs with more flexible requirements, as well as local assistance programs tailored explicitly for Texans. Understanding these options, including various loan types and refinance choices, will help you partner with a lender to choose the best financial path for your family.

Here is a breakdown of the most common and beneficial home loan programs available to help you purchase a house in Pecos, Texas.

A Conventional Conforming loan is a private-sector mortgage that “conforms” to the funding guidelines set by Fannie Mae and Freddie Mac. These are the most common loan types and generally require a minimum down payment of 3% for first-time homebuyers and a 5% minimum for others. The benefit of this loan is often the lower overall cost and the ability to eliminate Private Mortgage Insurance (PMI) once your loan-to-value (LTV) ratio reaches 80%. To qualify for this type of home purchase loan, you generally need a good credit score (typically 620 or higher) and a stable employment history.

An FHA loan is insured by the Federal Housing Administration, making it an excellent option for first-time homebuyers or those with less-than-perfect credit. The key benefit is the lower down payment requirement, often as low as 3.5%, and more forgiving credit score requirements. While they are more accessible, all FHA loans require a Mortgage Insurance Premium (MIP), which includes both an upfront fee and an annual fee for the life of the loan in many cases. Eligibility focuses on income and debt-to-income (DTI) ratios, with a minimum credit score often set at 580 to qualify for the lowest down payment.

The VA home loan is an incredible benefit exclusively for eligible U.S. veterans, active-duty service members, and select surviving spouses. The major advantage is 100% financing, meaning zero down payment is required, and it features competitive interest rates and no monthly private mortgage insurance (PMI). Eligibility is based solely on your military service history and receipt of a Certificate of Eligibility (COE) from the VA. The program has very flexible qualifying guidelines regarding credit and DTI, making it one of the most powerful mortgage financing tools available.

A USDA loan is a government-backed mortgage designed to promote homeownership in rural areas, and Pecos qualifies for this program. The immense benefit is that it offers 100% financing with no down payment for eligible low- and moderate-income buyers. Unlike other programs, eligibility is tied to two factors: the home must be located in an eligible rural area, and the applicant’s household income must not exceed limits set by the USDA. This is an exceptional Pecos home-buying option for those meeting the income requirements.

If you’re looking at a new or existing manufactured home in Pecos, specific financing is required because these homes are often not considered “real property” like site-built homes. While conventional, FHA, and VA loans can sometimes be used for manufactured homes that meet specific HUD-code requirements and are permanently affixed to the land, there are also specialized loan programs available. These loans cater to the unique appraisal and property requirements of manufactured housing, allowing you to secure competitive terms for this specific type of dwelling.

A Jumbo loan is a type of conventional mortgage used when the loan amount exceeds the conforming loan limit set by the Federal Housing Finance Agency (FHFA). In Pecos, where the average home price is lower, a jumbo loan would typically be for a much larger, higher-value property. The benefit is financing for luxury or high-end properties. Still, they require a higher down payment (usually 10% to 20%), stricter credit score requirements, and a larger reserve of cash post-closing due to the higher lending risk.

Non-QM loans are a flexible alternative that caters to borrowers who do not fit the strict documentation requirements of traditional mortgages (like conventional or FHA). This might include self-employed individuals, real estate investors, or those with unique income streams. The benefit is the ability to qualify using alternative methods like bank statements instead of tax returns. While they offer flexibility, these loans may come with slightly higher interest rates and typically require a larger down payment than conforming loans.

Refinancing your Pecos home mortgage can be a great way to manage your existing debt or improve your monthly budget. There are two primary types of refinancing:

A cash-out refinance is a type of refinance option where you take out a new, larger mortgage on your home that exceeds your current outstanding loan balance. The difference between the new loan amount and the old balance is paid to you as tax-free cash at closing. The benefit is that it allows you to tap into your home’s equity to fund major expenses, such as home improvements, education, or consolidating high-interest debt. You are essentially converting home equity into liquid cash, which you then repay through the new mortgage payment.

A rate and term refinance, on the other hand, changes the interest rate, the loan term (the length of time to repay), or both, without taking a cash outlay. For instance, you might refinance from a 30-year fixed-rate mortgage to a 15-year fixed-rate mortgage to pay off your loan faster, or you might refinance simply to secure a lower interest rate, which will reduce your monthly mortgage payment. The key benefit of a rate and term refinance is saving money over the life of the loan or adjusting your monthly payment to suit your current budget better. This option is often less complex and typically has lower closing costs than a cash-out refinance.

Buying a home or refinancing in Pecos doesn’t have to be complicated. At The Texas Mortgage Pros, we take the time to understand your goals, guide you through every step, and help you secure the best rates available. Whether you’re a first-time homebuyer or planning to refinance your Pecos property, we combine experience, integrity, and local insight to make your mortgage journey smooth and stress-free.

Testimonials

Ready to make your move? Securing the right mortgage for your new home in Pecos starts with a simple conversation. Understanding these various loan programs is the first step, but working with a knowledgeable local Pecos mortgage professional will ensure you match your financial profile with the perfect loan. Don’t let the process feel overwhelming; we are here to provide clear guidance, competitive interest rates, and a customer-centric approach to help you achieve your dream of homeownership in West Texas. Contact us today at (877) 280-4833 to get pre-approved and begin your journey.

Q: What Pecos-specific homebuyer assistance programs are available?

A: The Texas State Affordable Housing Corporation (TSAHC) offers statewide programs, which Pecos residents can utilize, such as the Homes for Texas Heroes Home Loan Program for local teachers, veterans, and first responders, and the Home Sweet Texas Home Loan Program for low and moderate-income homebuyers. These programs provide 30-year fixed-rate loans and down payment assistance (DPA) grants, which can significantly reduce your out-of-pocket costs.

Q: What is the minimum credit score required to get a home loan in Pecos?

A: The minimum credit score can vary depending on the loan program. For many government-backed loans, such as FHA or TSAHC programs, you may be eligible with a credit score as low as 620. However, for a conventional loan, a minimum score of 620 to 640 is generally required, and higher scores will always qualify you for better interest rates.

Q: Can I use a loan to purchase a manufactured home in Pecos?

A: Yes, manufactured home loans are available in Pecos. While they are a specialized product, certain VA, FHA, and conventional loan programs can be used, provided the home meets specific structural and foundation requirements (HUD-code and permanent attachment to the land). It’s crucial to work with a lender experienced in Pecos manufactured home financing to ensure the property meets all guidelines.

Q: How does the Pecos Housing Finance Corporation (PHFC) help local homeowners?

A: The Pecos Housing Finance Corporation (PHFC) is a local non-profit dedicated to expanding access to affordable workforce housing. While they plan to offer a Down Payment Assistance Program starting in September 2025, they currently focus on initiatives such as their Home Repair Program, which helps existing Pecos homeowners with essential repairs and improvements, promoting long-term community stability.