Discover the perfect loan to buy, build, or refinance your dream home in Bryan-College Station.

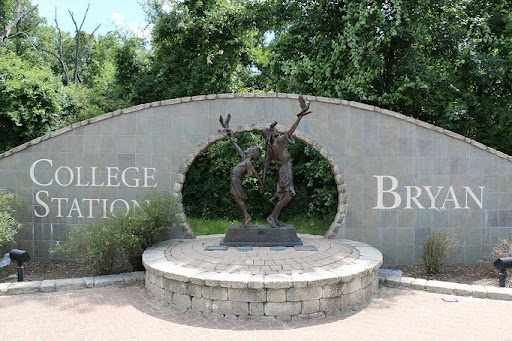

Bryan-College Station, nestled in the heart of Texas, is a vibrant community known for its friendly neighbors, strong schools, and the unmistakable spirit of Texas A&M University. Thanks to a robust local economy, affordable housing, and a mix of urban amenities with small-town charm, this area is a magnet for first-time homebuyers, families, and professionals, making the local real estate market both dynamic and welcoming.

"*" indicates required fields

When considering a home purchase in Bryan-College Station, you’ll find a diverse selection of mortgage programs tailored to suit all needs. Whether you’re a first-time homebuyer, a military veteran, or looking to refinance, there’s a loan product designed for your unique situation. Understanding your loan options is the first step to making a sound and confident investment in your future.

Backed by the Federal Housing Administration, FHA loans make homeownership possible for buyers with lower credit scores or smaller down payments.

Benefits:

FHA loans are ideal for those with lower credit scores or limited savings for a down payment. They offer lenient qualification standards, allow gifted down payments, and require only 3.5% down for those with a credit score of 580 or higher. These loans can help open the door to homeownership for many first-time buyers.

Eligibility:

Eligibility is open to buyers using the property as their primary residence. You’ll need a minimum credit score of 580 for a 3.5% down payment, or as low as 500 if you can put down at least 10%. As with most loans, your ability to repay and income stability are also reviewed.

Available to eligible veterans, active-duty service members, and select military spouses, VA loans are backed by the Department of Veterans Affairs.

Benefits:

VA loans stand out for offering zero down payment, no private mortgage insurance (PMI), and access to competitive interest rates. These benefits drastically reduce upfront costs and monthly payments for eligible military personnel and their families.

Eligibility:

Eligibility is reserved for veterans, active-duty service members, and certain surviving spouses of veterans. You’ll need a valid Certificate of Eligibility (COE), sufficient credit, and income to prove you can repay the loan. The home must also serve as your primary residence..

Conventional-Conforming Loans

These are the most popular loans, ideal for borrowers with good credit and sufficient income. The federal government doesn’t back them, but they adhere to Fannie Mae and Freddie Mac standards.

Benefits:

Conventional conforming loans offer competitive interest rates and flexible terms, making them a popular choice for buyers with strong credit histories. You can use these loans to purchase a primary residence, second home, or investment property, and you can put as little as 3% down if you meet certain criteria. These loans are also appealing due to the absence of government-imposed borrowing limits or restrictions on property type.

Eligibility:

To qualify, you typically need a minimum credit score of 620, stable income, and a manageable debt-to-income ratio. You’ll also need to meet documentation standards and provide proof of assets for the down payment and reserves.

Jumbo Loans

Designed for properties that exceed conforming loan limits, jumbo loans allow qualified buyers to purchase high-value homes.

Benefits:

Jumbo loans allow you to finance high-value or luxury properties exceeding conforming loan limits. They offer flexibility in loan terms for buyers with strong financial profiles.

Eligibility:

You’ll generally need a high credit score (typically 700 or above), a substantial down payment (10–20% or more), and a low debt-to-income ratio. Lenders will also require documentation of steady, significant income.

Specialized financing for buyers seeking an affordable alternative through manufactured or mobile homes.

Benefits:

Manufactured home loans make homeownership accessible with lower-priced housing options and a variety of government-backed and conventional loan choices. This is ideal for buyers seeking affordable alternatives outside of traditional site-built homes.

Eligibility:

Eligibility varies by program, but the home must usually be built after 1976, meet HUD standards, and be permanently affixed to the land. Borrowers must also demonstrate reasonable credit and verifiable income, and sometimes make a larger down payment compared to traditional homes.

USDA Loans

Offered by the U.S. Department of Agriculture, USDA loans help low- to moderate-income buyers purchase homes in designated rural areas, which include parts of Brazos County.

Benefits:

USDA loans provide 100% financing, meaning no down payment is required. They also come with lower mortgage insurance costs, making them a highly affordable option for eligible buyers, especially in designated rural or suburban areas.

Eligibility:

To qualify, you must purchase a home in a USDA-eligible location, and your household income cannot exceed county-specific limits. You must also use the home as your primary residence and show proof of stable income.

This type of refinancing replaces your existing mortgage with a new one at a different interest rate or term, such as a shorter repayment period.

Benefits:

A rate and term refinance helps you lower your interest rate or change your repayment period, potentially reducing your monthly payment or allowing you to pay off your mortgage faster.

Eligibility:

To qualify, you’ll need a good credit score, stable income, and sufficient home equity. Lenders will evaluate your overall financial standing to ensure you can manage the new loan terms.

A cash-out refinance lets you access the equity in your home as cash, replacing your current mortgage with a new, larger loan.

Benefits:

Cash-out refinances let you access your home equity as cash, which can be used for renovations, major purchases, or debt consolidation—often at a lower rate than other types of credit.

Eligibility:

Eligibility requires significant equity in your home (typically at least 20% remaining after cashing out), a qualifying credit score, and verifiable income. Lenders also assess your overall financial stability to determine how much equity you can tap.

For buyers who don’t fit standard lending guidelines, such as self-employed individuals or those with unique financial situations, Non-QM loans can provide alternative approval paths.

Benefits:

Non-QM loans are tailored for borrowers with unique financial situations, like self-employed individuals. They may accept alternative forms of income documentation and can be more flexible regarding credit history.

Eligibility:

Eligibility standards are broader, but lenders still require you to demonstrate the ability to repay. You may face higher interest rates and be required to make a larger down payment compared to standard loans.

Q: How do I know which home loan in Bryan-College Station is right for me?

A: Consider your financial situation, credit score, down payment ability, and whether you qualify for special programs, such as VA or USDA loans. A mortgage professional can help match you with the best product.

Q: Can I buy a manufactured home with a government-backed loan?

A: Yes, both FHA and VA loans can be used for manufactured homes that meet specific HUD standards and are permanently attached to land.

Q: What credit score do I need to qualify for a mortgage in Bryan-College Station?

A: Most conventional loans require a credit score of 620 or higher. FHA loans, on the other hand, start at 580 (with a 3.5% down payment), but higher scores can improve your terms and lower your costs.

Q: Is it possible to buy a home in Bryan-College Station with no money down?

A: Yes, eligible borrowers may qualify for VA or USDA loans, both of which can offer 100% financing with no down payment required.

Testimonials

Ready to turn your Texas dream into a reality? Whether you’re buying your first home, upgrading, or looking to refinance, Bryan-College Station offers opportunity, stability, and a place to call home.

Connect with our local mortgage expert today at (877) 280-4833 to explore your options, get pre-approved, and move forward with confidence in one of Texas’s most welcoming communities. Your next home is waiting!

Buying a home isn’t just a financial decision—it’s a deeply personal journey toward security, stability, and a place to call your own. At The Texas Mortgage Pros, we don’t see you as just another loan application. We see your dreams, your family’s future, and the life you’re building. With us, you gain a trusted partner who fights for the best rates, listens to your needs, and guides you every step of the way—so you can move forward with confidence and peace of mind.